What Happens When You Are Named The Executor of a Will

Categories

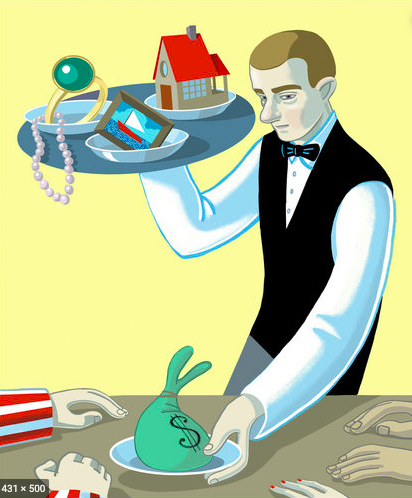

If you are named as an executor for someone’s will you should consider it an honor. That person believes that you have the ability to settle debts, distribute assets and complete all the tasks necessary to close out their estate.

Even though you are not required to accept this position, most executors feel compelled to comply with the wishes of their dear friend or family member.

Typically an executor is a close relative or a spouse. The executor may also be a beneficiary in the will, a pretty common occurrence.

Duties of an Executor

The executor of an estate has many responsibilities and duties.

File the will. The will and the death certificate must be filed with the county probate court. This is necessary even if the assets may all go to the surviving spouse. Once the will is filed with the courts, the court clerk will issue you the letters testamentary, making you the fiduciary of the decedent’s estate.

Open an estate account. You will use this to pay all debts, expenses, and taxes.

Notify others. The executor must notify friends, family, financial institutions, and government agencies, including Medicare, insurance companies, social security administration, banks, etc.

Pay debts and taxes. All debts should be paid before any assets are distributed.

Locate and manage assets. Assets are anything inside the decedent’s home, any cars in their name, rental property, and their primary residence. All assets should be protected and maintained until the probate process is complete.

Distribute all assets. Once all debts and taxes are paid, all assets should be distributed.

Estate executors are usually paid for their duties. If the decedent does not specify an amount, the court will decide. Any compensation received from these fiduciary duties should be reported as income on tax returns.

Learn more about things you should know before accepting the role of executor here.

Contact Us

Kevin Miller is ready to assist you in creating an estate plan so you are not caught off guard in an uncertain time. It is important that you make creating a will a priority, regardless of your age or amount of assets. Kevin Miller has extensive experience in estate planning and will put your interests first. Contact us or call us at 405-443-5100 if you have questions. We are here to help.